Renting VS Buying - A Clear Winner?

Renting vs Buying - A Clear Winner?

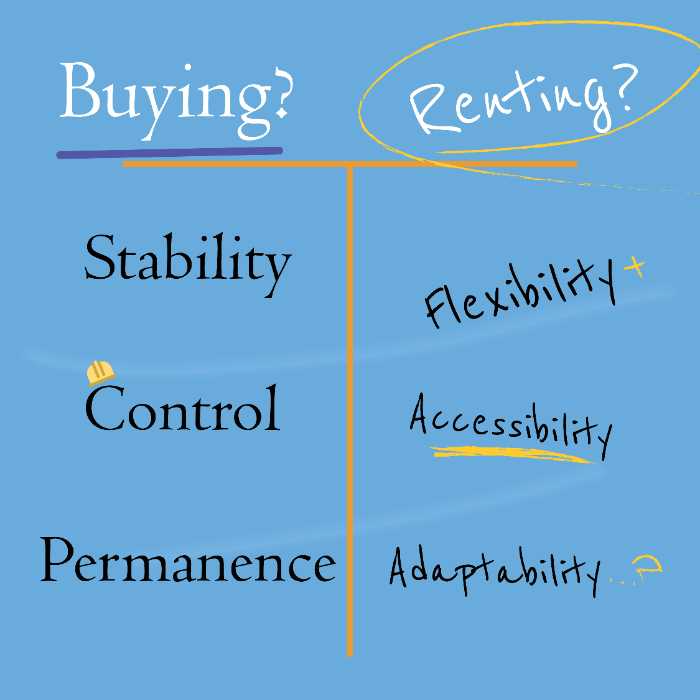

There are many factors that go into deciding if you want to buy a house or rent. Even though it may seem like buying is the best choice, renting has its benefits as well.

One of the benefits of renting a house is that it's cheaper than buying. When you rent, there are two fixed costs that you have to pay each month: The monthly rent and property taxes. You don't have to pay for any repairs or maintenance, so there are no unforeseen expenses when something breaks in your own personal home. Sure, if you rent, you don't have ownership of the house. But most renters are happier having their money available for more important things - like saving up to eventually buy a house.

Buying a property means you own it. Although you have to pay for repairs yourself, you don't need to deal with a landlord. Speaking of the latter, there is no need to consult with anyone when it comes to decorating and upgrading your home. At your heart's content, you can drill holes and break down walls - just make sure you aren't knocking down the ones your house needs to stay up. And in the longterm, owning your own home ends up being cheaper than continuously paying for rent.

While renting gives you the flexibility to move when you need to, having a house means that you will always have somewhere to go to. If you live a life where you don't travel for long periods of time and plan to have a family, a house seems ideal. But not everyone leads the same life.

Deciding on what's best for you is a game of juggling compromises and understanding what you would benefit from the most. For the vast majority of people, their finances will dictate that they make a choice - after all, if you had more than enough then a house in a great location and apartments all around the world would be perfect. Sadly, we can't all be jet setters.

There are two major questions you need to ask yourself first.

How often are you planning on moving?

Unless you buy a home outright, paying the totality of its asking price on the spot, you will be tied to a mortgage. A long term loan that finances your ownership of the house. Eventually, it will be paid off. Eventually. If staying in one spot for a long period of time, five years or more, is something you are looking for then buying becomes obvious. The savings over time will help you use your income for new life projects or literally anything that is not paying a landlord.

The other end of the spectrum is one where you plan on living "where the wind takes you." Going from job to job, life to life, does not gel well with an empty house. Especially when how expensive a downpayment can be. Though this situation is often not permanent though, people who lead lives like these tend to settle somewhere eventually.

This may be the most crucial question to answer for yourself first. Are you at a stage where you will plant roots or will you wander off to different pastures?

How much control do you need over your living space?

Renting usually involves a safety deposit, a sum of money used to pay for any damages that the rental unit might incur during your stay. That is what your landlord will use if you try to change parts of your unit like the paint, appliances, and fixtures. If you're someone that needs to be able to change all the aspects of your living area, an apartment would be an exercise in frustration.

On the other hand, if you are satisfied with the way the rental space looks and if you don't feel the need to change the items listed previously, renting can be a great option.

Possible Pitfalls

Now, after answering those questions you still need to consider the risks laid out ahead. Even if your heart is set on buying a house, jumping on the first house that fits your criteria may not be the best solution. Hasty home purchases can mean skipping common precautions like home inspections.

Hidden costs from hasty decisions can heavily hamper your plans, locking you into mortgages and homes far from your standards. Meanwhile, prioritizing short term comforts of beautiful and expensive apartments can seriously impede your ability to save up for a house.

Above all, the most important thing is to keep your future plans in mind when making a decision so that you don't lock yourself out of the perfect opportunity.

View All Homes For Sale in Greater Vancouver >>>

About Search Home Listings

SearchHomeListings.ca has simplified the home buying and selling process by giving you superior tools with up-to-the-minute information including active homes for sale, sold homes, market reports, and a home valuation tool! We have a team of success managers on standby to support you with setting up your saved home search and agents ready to take you out on a tour. Tap into our industry experts from inspectors, to contractors to interior designers to provide you with the best prices and service possible. Everyone attached to our website has been rigorously vetted and is made up of caring, knowledgeable professionals that work tirelessly to help you to make your home buying experience as stress-free as possible. Contact us today to see how we can help!

Sites We Follow

Categories

Recent Posts